At 28billion USD ,China's debt levels have surged

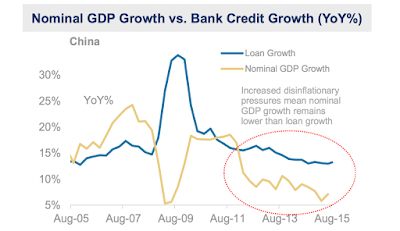

As a proportion of GDP chinese debt accelerated moderately from the turn of the century. In 2007, it was 121% of GDP. Today it's more than twice that — 282%

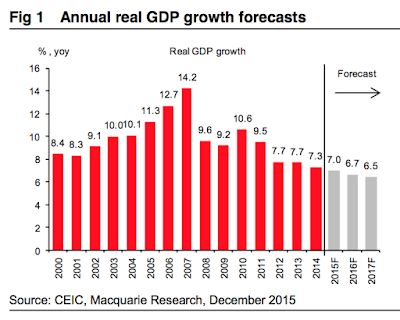

After an indifferent 2015, Global markets started off terribly, with china sending shock waves across the world and setting global stock markets into a panic mode .And many believe that china could get even worse and lead the world into another financial crisis. George Soros has already "predicted that china will set up a repeat of 2008. And if that was not enough this recent chart from HSBC warns that China could be about to go into full-blown "crisis" mode.

China is about to get caught up in a death spiral of falling demand and mountains of debt which will mean a meltdown and a disaster for the rest of the world. The Caixin Purchasing Managers Index for manufacturing, which measures economic activity, came in at 48.2. Anything below 50 signals contraction and last week's reading marks the 10th straight month China's industry has shrunk.

These charts from Businessinsider shows 3 reasons why global markets are panicking .China's total debt is now about $28 trillion, larger than that of the United States or Germany,

No comments:

Post a Comment