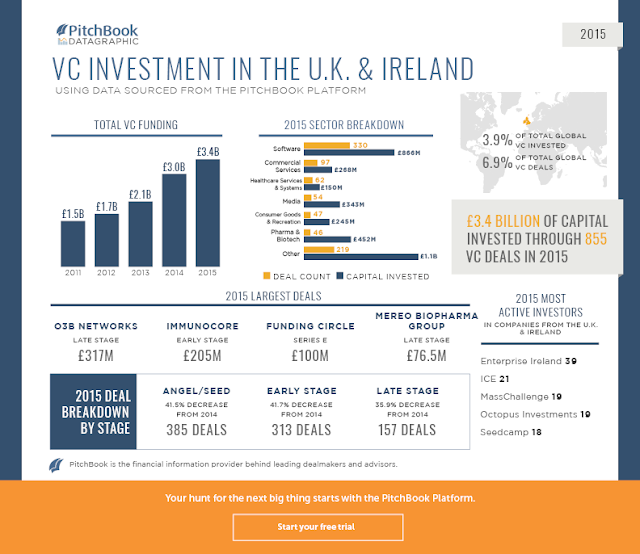

VC INVESTMENT IN UK last year reached 3.6 billion euro with UK and Ireland accounting for 7% of global VC deals in 2015. The UK tech sector received 70 per cent more funding from VCs last year, compared with 2014, with start-ups gaining just $2.1bn in 2014,according to research

based on the data from CB Insights and London & Partners,

However this number pales into insignificance when compared to VC investment and start up growth in US and silicon valley miles According to the US National Venture Capital Association, $35.7bn was invested in tech companies by US venture funds in 2014 alone.

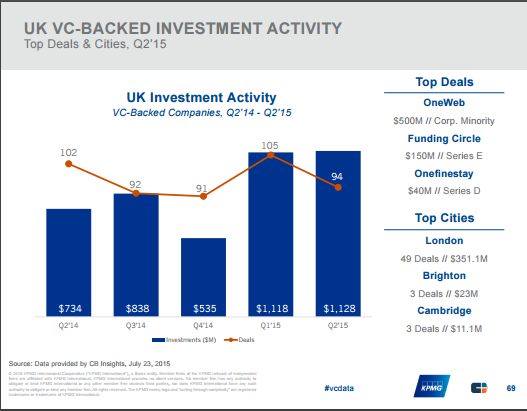

However UK has traditionally seen increasing VC funding across financial technology start ups. In 2015 Britain's financial technology( fintech) investments has seen significant upside with several

funding rounds in the vertical which included Ebury, a group that helps small businesses trade internationally, which raised $83m; Funding Circle, the peer-to-peer lender, which raised $150m; and WorldRemit, a money transfer group, which raised $100 million

UK's strength has been its proximity with the financial centre of London, where it scores over " the silicon valley's software power centre

based on the data from CB Insights and London & Partners,

However this number pales into insignificance when compared to VC investment and start up growth in US and silicon valley miles According to the US National Venture Capital Association, $35.7bn was invested in tech companies by US venture funds in 2014 alone.

However UK has traditionally seen increasing VC funding across financial technology start ups. In 2015 Britain's financial technology( fintech) investments has seen significant upside with several

funding rounds in the vertical which included Ebury, a group that helps small businesses trade internationally, which raised $83m; Funding Circle, the peer-to-peer lender, which raised $150m; and WorldRemit, a money transfer group, which raised $100 million

UK's strength has been its proximity with the financial centre of London, where it scores over " the silicon valley's software power centre

No comments:

Post a Comment