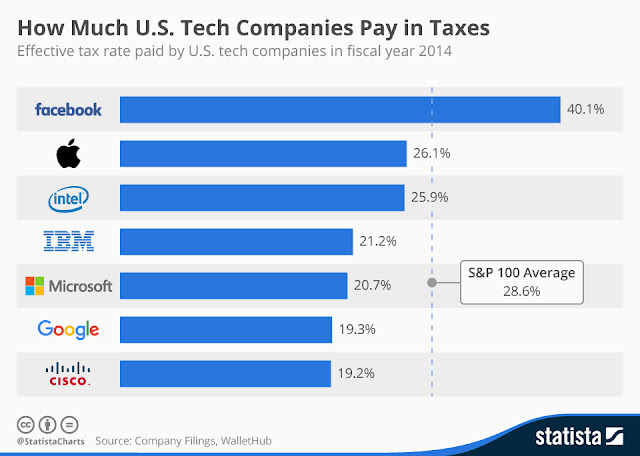

How much do the top tech giants pays as tax ? This question has been asked across the political spectrum as well as across business meetings. Time and again both legislators and senators have questioned Large tech companies such as Apple and Google who are often accused of avoiding U.S. taxes by stashing foreign earnings in countries with lower corporate tax rates.This chart tries to dig through the reality

Taxes paid by the technology giants it definitely not in line with the kind of profits these companues make.In 2014, Apple paid $13.97 billion in income taxes, which is more than what IBM, Microsoft and Google paid combined. More importantly though, Apple’s effective tax rate (the average rate at which pre-tax profits are taxed) in 2014 was 26.1%. While that is actually higher than it is for many of its fellow tech companies, it is 2.5 percentage points below the average tax rate paid by S&P 100 companies in 2014, not to mention the statutory federal income tax rate of 35%.

Taxes paid by the technology giants it definitely not in line with the kind of profits these companues make.In 2014, Apple paid $13.97 billion in income taxes, which is more than what IBM, Microsoft and Google paid combined. More importantly though, Apple’s effective tax rate (the average rate at which pre-tax profits are taxed) in 2014 was 26.1%. While that is actually higher than it is for many of its fellow tech companies, it is 2.5 percentage points below the average tax rate paid by S&P 100 companies in 2014, not to mention the statutory federal income tax rate of 35%.

No comments:

Post a Comment